Employment Practices Liability Insurance: Sued By Your Employees

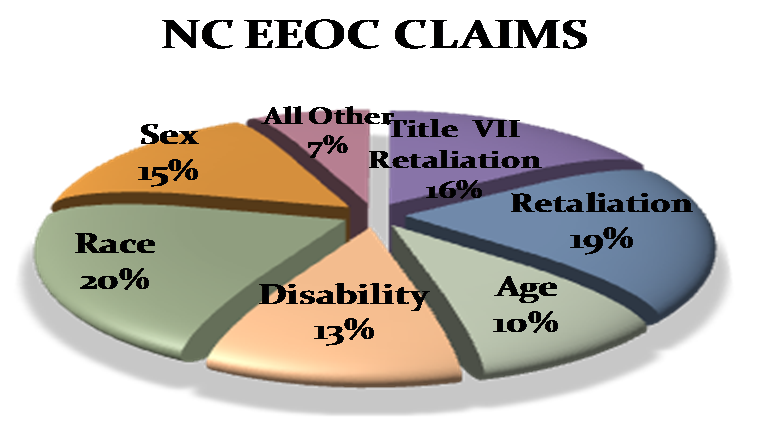

In 2012, North Carolina was ranked #4 in the list of states with the most Equal Employment Opportunity Commission (EEOC) claims. The NC is #2 when looked at as a percentage of claims by population.

North Carolina is an Employment-At-Will State. You can fire an employee for almost any reason, but you can't fire someone or discriminate against a job applicant based on race, color, religion, sex (incl. pregnancy), national origin, age, disability, if they filed a Workers Comp claim or because the person complained about discrimination. Allegations of violations of the laws are bought to the EEOC. The fact that NC has so many EEOC claims shows that being a "right-to-work" state doesn't take away an employee's right to sue. This risk is called Employment Practices Liability (EPLI) and is excluded on a standard liability policy.

An example we saw locally:

Two employees of different races worked together for years. They were seen as the best of friends. As workers often do, they gave each other nicknames, and everyone laughed. Years later, one of the employees quits and told the employer that it was because he was called a nickname that was racially derogatory and that management knew about it for years and did nothing. No one saw it coming.

Your employee may be able to get an attorney to sue you with no out of pocket costs. Just proving your innocence could cost hundreds of thousands. Well run businesses can be bankrupted just proving the fact that they did nothing wrong.

Accusations can range from failing to hire someone because they are pregnant to firing because they are too old.

EPLI insurance will often provide free legal advice from employment law attorneys and guide you in evaluating your current employment practices for potential law suits.

2012 NC EEOC Claims

Source: eeoc.gov

DHB Commercial Insurance | DHB Business Newsletter | Request A Quote or Contact Us